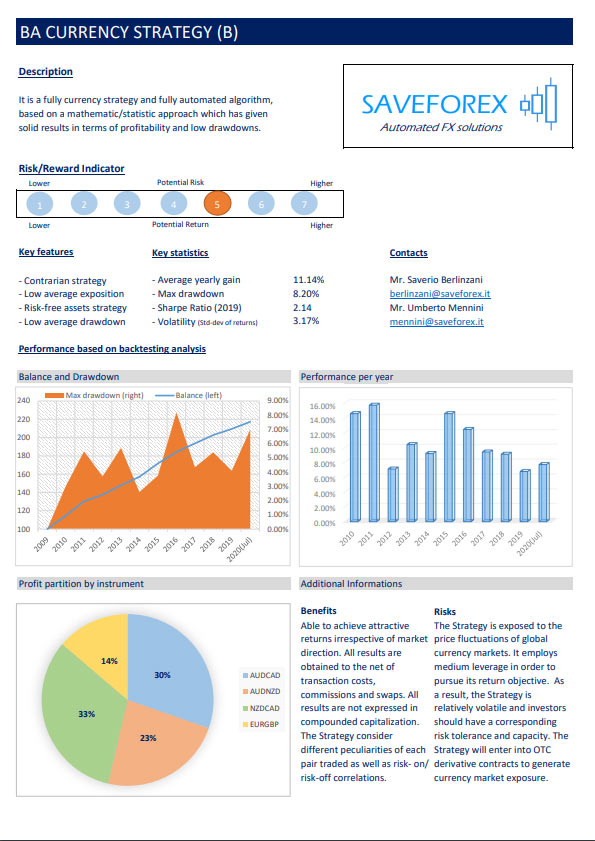

Il BA V.8.0 è un algoritmo (trading system) ideato da Saverio Berlinzani e Umberto Mennini, per il mercato valutario (FX).

Questa ultima versione, sviluppata successivamente alla crisi Covid-19, è molto diversa dalle precedenti. Di fatto, al verificarsi della pandemia Covid-19, Saveforex si è resa conto che le precedenti versioni non rispettavano alcuni precisi standard di sicurezza (soprattutto per via della situazione assolutamente anomala verificatasi sui mercati). Per questo motivo è nata la necessità di costruire un sistema meno volatile in termini di drawdown, meno profittevole in termini di gain percentuale sul capitale investito, ma inequivocabilmente più sicuro delle precedenti versioni e capace di gestire eventi anomali, mai verificatisi prima sui mercati, come il Covid-19.

Per prima cosa, la strategia utilizza solo 4 tassi di cambio contro i 15 precedenti, per una più semplice gestione delle posizioni in situazioni particolarmente critiche sui mercati. La scelta dei tassi di cambio è stata indirizzata verso quelli meno volatili, trattandosi di una strategia contrarian, tenendo conto delle diverse correlazioni e dei diversi comportamenti delle coppie valutarie durante le fasi di risk-off/risk-on sui mercati.

In secondo luogo, è stata ridotta la leva finanziaria: circa il 66% della leva originale della precedente versione.

I risultati nel seguente file PDF sono personalizzabili, mantenendo lo stesso rapporto gain/drawdown, a seconda della personale propensione al rischio di ogni singolo utente.

I risultati nel seguente file PDF sono il risultato di un’analisi quantitativa effettuata con il software MatLab, in backtest, dal Gennaio 2010 al Luglio 2020 (crisi Covid-19 inclusa).

Non è possibile utilizzare il software con un capitale a disposizione inferiore ai 50.000 EUR (50mila).

Per qualsiasi informazione potete contattare direttamente mennini@saveforex.it / berlinzani@saveforex.it

CONTO PILOTA: https://www.myfxbook.com/members/Saveforex/ba-v80-activ/6542483

Recensioni dei clienti

Francesco Di Ruocco

Utilizzo il sistema BLUATLANTICO da circa un mese e mezzo.

Il prodotto si presenta con una veste grafica

accattivante, pulita, davvero curata.

Il punto di forza è che non richiede alcuna configurazione, si attiva con

il pulsante on ed è operativo.

Considero utile la possibilità di inserire manualmente dei livelli di entrata con

ordini che vengono oscurati al broker.

In tal modo si può intervenire discrezionalmente e si evitano

slippages indesiderati. Opera su quindici coppie di valute e da una attenta osservazione si nota la cura con

cui sono state scelte.

Si è cercato di evitare che si possa creare una eccessiva esposizione su un solo lato del

mercato. Dal punto vista dell’operatività, anche se a prima vista può sembrare una limitazione, apprezzo la

scelta di bloccarne l’utilizzo al disotto di un certo capitale, di usare leve basse e di inserire sistemi di

protezione.

È sintomo della volontà di proporre un prodotto serio, affidabile e professionalmente curato,

che dà all’utilizzatore la tranquillità di lasciare operare il sistema h24 senza preoccuparsi di incorrere in

drowdown inaspettati o addirittura di bruciare conti. Siamo ben lontani dal solito specchietto per allodole

che promette guadagni facili e milionari.

Eppure se si considera il guadagno del primo periodo è tutt’altro

che trascurabile: 2% circa con drawdown irrisorio, il tutto in un periodo di bassissima volatilità.

Supporto e

assistenza sono costanti, gli aggiornamenti continui.

Pienamente soddisfatto

Manlio Guerzoni

Gent.mo Sig. Berlinzani buongiorno.

Sono ad inviarle questa mail per esprimerle la mia piena soddisfazione sull'expert BA e, soprattutto, per

congratularmi con lei e con tutto il suo staff per l'ottimo prodotto realizzato.

In un mercato come quello attuale caratterizzato da assenza di movimenti per ore con improvvisi bruschi

movimenti violenti, BA riesce a prendere posizione e, soprattutto, a portare profitto.

Per darle un idea, anche se ritengo non ce ne sia bisogno, con i soli movimenti di questa notte il BA si è ampiamente ripagato.

Non le nascondo che attendo con una certa impazienza un ritorno alla normalità dei mercati perché ritengo che a quel punto BA possa esprimere al meglio tutte le sue potenzialità.

Rinnovando i complimenti a lei e al suo staff, sono a ringraziarla e salutarla cordialmente.

Giancarlo Mazzocchi

Ho sottoscritto l'abbonamento al EA BLUATLANTICO.

Importante prima di tutto sottolineare l’ottima assistenza e gli aggiornamenti che vengono gestiti velocemente e professionalmente.

Non si viene mai abbandonati.

Il prodotto è molto solido con un eccezionale controllo e gestione del rischio.

I rendimenti sono costanti e i drawdown rari.

In poche parole un ottimo prodotto, professionale fatto da chi conosce bene i mercati.

Maury

Ciao Saverio buongiorno,

Avendo avuto in passato una personale esperienza con gli expert advisors, a volte fallimentare a volte

meno, e conoscendo profondamente l'impegno e la costanza che ci vogliono per realizzarli, posso

affermare che il risultato che hai ottenuto con BLUATLANTICO non è solo soddisfacente, è straordinario! E

questo sia in termini di prestazioni che di sicurezza.

Le idee che ne compongono la struttura sono chiaramente il succo di una conoscenza notevole dei mercati, e questo robot non poteva che essere

eccellente.

Lo consiglio vivamente a chiunque, neofita o esperto, voglia supportare la propria metodologia

di lavoro e avere un ottimo affidabile alleato.

Ciao Saverio, grazie e a presto.

Giulio Mastrosimone

Devo dire che non ho molta esperienza in sistemi robotizzati che fanno trading ed all'inizio ero anche molto scettico, poiché i sistemi automatizzati,

che si fondano sull'analisi tecnica, hanno efficacia solo per un certo tipo di mercati e poi quando cambia il mercato diventano obsoleti.

Così non è per il BA che lavora con strutture matematiche, quindi più solide e meno soggette ai cambiamenti di mercato.

Il bello di questo sistema è che da subito vedi i profitti e il Drawdown è molto contenuto, da quando io l'ho acquistato (circa tre mesi) non è andato mai sotto il capitale investito

e ha tenuto una media dello 0,8% mensile di guadagno (n.b. risultato ottenuto con mercato a bassissima volatilità).

Un prodotto che da una marcia in più al tuo trading, anche perché aiuta a capire i livelli di eccesso dei mercati e poter così aiutarti nel trading discrezionale.

Lo consiglio vivamente per chi è alla ricerca di un sistema automatizzato veramente profittevole.

Giulio Bogliotti

Carissimo Saverio,

sto utilizzando BLUATLANTICO (vers. 5.2 – pc portatile) dal 6 maggio 2019 e lo trovo veramente eccezionale.

Ho deciso, fin dall’inizio, di lasciarlo lavorare senza alcun intervento da parte mia ed i risultati sono decisamente premianti.

Dal 6 maggio al 5 giugno ha fatto l’1,56%!!

Ma il risultato è tanto più interessante se consideriamo il fatto che il broker, nello svolgimento della funzione di sostituto d’imposta, mi trattiene già l’imposta dovuta.!!! Quindi il risultato è praticamente al netto delle spese.

Avete costruito una “macchina” micidiale e, quando nella chat la chiamate BA, non penso solo a BLUATLANTICO, ma mi viene in mente subito BombA.

Colgo anche l’occasione per sottolineare la grande disponibilità che avete messo in campo per aiutare a superare ogni tipo di problema: dalla lettura ed interpretazione dei mercati, alle questioni prettamente tecniche di installazione e gestione/comprensione di BA.

GRAZIE Saverio, GRAZIE Umberto

Filippo Vandi

Il trading system Bluatlantico lo sto utilizzando da più di un mese e anche se il mercato si trova attualmente in una fase di bassa volatilità il sistema riesce a creare profitti in maniera

contiunativa con draw down relativamente bassi.

Il sistema oltre ad avere la possibilità di essere manipolato in maniera discrezionale lavora ottimamente in modo completamente automatico 24 ore al giorno,

questo permette di potersi dedicare al trading discrezionale senza alcun pensiero.

Personalmente lo reputo un ottimo prodotto perchè stabile ed efficente dedicato a chi cerca una diversificazione ai propri investimenti.

Complimenti anche ai creatori che grazie alla continua assistenza sono un ulteriore punto a favore non trascurabile di questo strumento professionale.